Key points from article :

Novocure recently secured a CE mark in Europe for its Tumor Treating Fields (TTF) therapy, marketed as Optune Lua, to treat inoperable, advanced, or metastatic malignant pleural mesothelioma. This rare form of lung cancer, often caused by asbestos exposure, presents challenging treatment options, and TTF aims to address this gap.

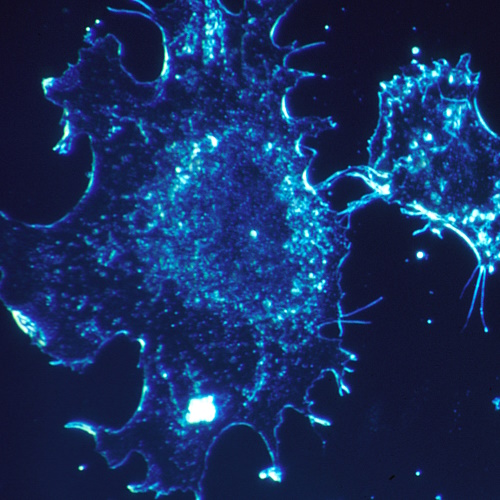

The therapy, worn as a large pad on the chest, emits electromagnetic energy directly into the tumor area, disrupting the division and replication of cells of specific sizes, which helps slow the spread of cancer. The device had previously gained FDA approval in the United States as a first-line treatment for mesothelioma, where it’s typically used in combination with chemotherapy agents like pemetrexed and platinum-based drugs.

Europe sees approximately 13,000 mesothelioma cases each year, and Novocure now plans to expand its commercial efforts and seek reimbursement pathways for this innovative treatment across the continent. To support its commercial expansion, Novocure established a $150 million revolving line of credit with JPMorgan Chase and raised $575 million from convertible senior notes, netting an estimated $558 million post-expenses. These funds will not only back commercialization but also ongoing clinical trials and product development.

The financing arrangements provide flexibility, allowing the company to strengthen its capital structure and support near-term growth.

This capital will facilitate investments in both clinical and product development programs, expanding the reach of their approved treatments in more regions. Additionally, the funds support Novocure’s goal of launching multiple large indications, potentially all at once, across several markets, thus broadening access for patients in need.