Maxwell’s AI-first health platform is thriving. The company is now cash-positive from strategic investments. Its branches—ranging from cosmetics to biodefense—are beginning to bear revenue. India, the FDA, and sovereign wealth funds are all in the picture.

Let’s explore how this Money Tree is growing.

Investment Milestones

Maxwell now operates on positive investment cash flow. This includes covering major expenses in the past six months:

- Legal and technical diligence for deals in cosmetics and coatings

- Administrative and R&D costs for biodefense partnerships

- India grant application and subsidiary planning

- Ongoing talks with sovereign wealth funds

- These strategic efforts prepare Maxwell for a sustainable financial future.

Building the Money Tree

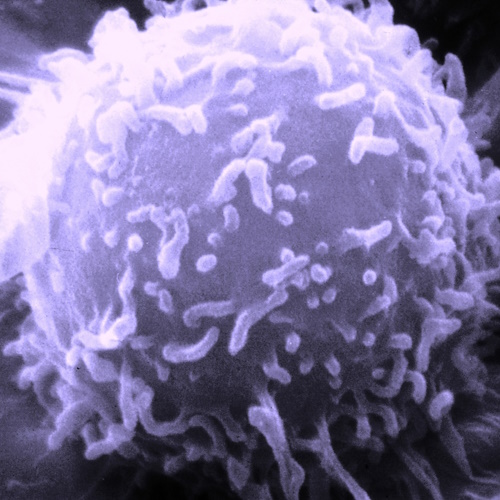

Maxwell is more than a biotech firm. It’s a health platform with strong roots. Over 250 peer-reviewed publications and $47 million in R&D support this growth.

Its model mimics nature: adaptive, nonlinear, and responsive to opportunity.

Each revenue path feeds the trunk:

1. FDA-Targeted Nasal Therapy

Focus: Chronic rhinosinusitis and brain fungal infections

Status: Completing preclinical studies and raising non-dilutive capital

2. Cosmetics

Focus: Microbiome-friendly antiseptics

Partner: Global cosmetics brand

Market: $500B+

3. Coatings and Sprays

Focus: Safe hygiene for homes and hospitals

Status: Commercialization phase

Outlook: Hundreds of millions in revenue

4. Biodefense

Focus: Wound care, exotic pathogens

Progress: $3M awarded in 2025, with up to $100M expected by 2026

Vision: Billion-dollar scale by 2027

5. India Public-Private Partnerships

Focus: Sepsis, sinusitis, brain infections

Projection: Over $400M in government funding

Start: Revenue coming soon

6. Livestock Health

Focus: Camel care in Gulf and Asia

Each path is advancing steadily toward revenue. Together, they reduce risk and strengthen the platform.

What’s Coming Next

India-based revenue to begin shortly

- Cosmetics and coatings income may land this year

- FDA trial prep underway pending capital

- Biodefense funding expected mid to late 2026

- Momentum is high and future projections are strong.

AI: Maxwell’s Secret Weapon

AI guides Maxwell’s evolution. From drug discovery to operational streamlining, artificial intelligence remains central. New hires and applications are in the pipeline. Stay tuned for announcements.

Maxwell calls its investors the roots of the Money Tree. Their capital powers this adaptive, diversified, and ambitious growth.