Key points from article :

Cambridge-based biotech Bicycle Therapeutics is gearing up for a transformative 2025, driven by strong financial backing and a promising pipeline of precision cancer therapies. CEO Kevin Lee highlighted the company’s robust 2024 results, including a hefty cash reserve of nearly $880 million—raised largely through a successful Nasdaq equity offering—which should fund operations well into late 2027. This financial strength supports ongoing development of innovative treatments aimed at improving outcomes for cancer patients worldwide.

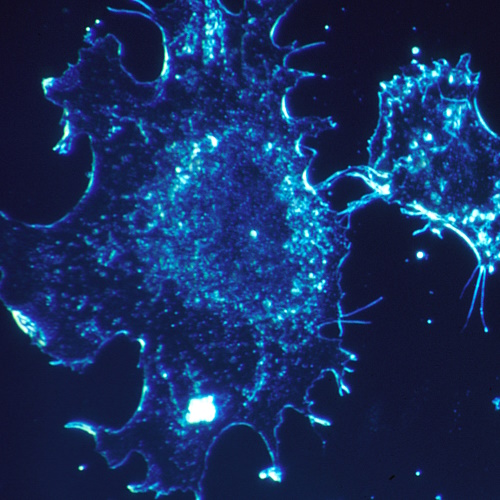

A key focus is zelenectide pevedotin, a drug showing encouraging anti-tumour activity and a safer profile for metastatic urothelial cancer and other tumours with NECTIN4 gene amplification. Additionally, Bicycle’s technology platform is advancing novel radiopharmaceuticals, exemplified by promising first human imaging results for their MT1-MMP target, potentially expanding cancer treatment options.

Despite a net loss of $169 million for the year, Bicycle Therapeutics increased R&D spending to push forward clinical trials and maintain a strong pipeline. CEO Lee remains optimistic, emphasizing their clear strategy and solid financial runway as they prepare to execute across oncology, radiopharmaceuticals, and partnerships to bring next-generation therapies to patients.